In the last five years, India's scheduled commercial banks (SCBs) have together written-off nearly Rs 10 trillion worth of bad loans, a sum that is close to the combined expenditure on health and education budgeted for 2021-22 by the centre and states (Economic Survey 2021-22: 352).

At a time when many forms of welfare expenditure are being cast as wasteful by the centre, there is surprising quietude over the trillions of rupees worth of bad loans, mostly owed to the public sector banks (PSBs), being written off the banks' balance sheets. Without large-scale taxpayer-funded bailouts, many of the PSBs would have breached the capital adequacy ratios because of losses on account of such write-offs (RBI 2021: 57). There can hardly be a better example of "irrational freebies" than the massive bank write-offs of non-performing assets (NPAs) occurring in India under the BJP government (2014–), which is also causing significant losses to the state exchequer. The matter cannot be relegated to the margins of public discourse.

From ‘riskless’ to 'freebie' capitalism

The story begins with the growth acceleration in the Indian economy during the early 2000s. This was led by a substantial increase in domestic investments, especially in the infrastructure sectors, alongside a rise in export demand. Gross Fixed Capital Formation (GFCF) as a share of GDP rose to almost 36% per cent in 2007–08, on the eve of the global financial crisis, from 26% in 2000–01, according to data from the government’s National Statistical Office. Even against the backdrop of the global recession, India maintained an investment rate of over 33% between 2008–09 and 2012–13, after which it declined steadily.

This phase of investment-led growth occurred alongside a surge in bank credit. PSBs played a leading role in financing the vast menu of public as well as public-private partnership (PPP) projects, from power plants and highways to airports, ports, telecoms, and IT infrastructure (Azad, Bose, and Dasgupta 2017). The credit space vacated by state-sponsored development financial institutions, which had by then either been privatised or wound up, was filled by PSBs since private banks were unwilling to take the risk.

Once losses started accumulating in the private sector, companies started defaulting on their loans, in effect offloading the losses on to the major lenders, the PSBs.

Public sector banks accounted for almost three-quarters of gross advances between 2004–05 and 2008–09; a period when gross advances by SCBs grew by an unprecedented 38% on average annually. This growth rate, during the tenure of the UPA-I government, came down to around 18% between 2009–10 and 2013–14, the UPA-II years. 1Data on gross advances and NPAs are sourced from Statistical Tables Relating to Banks in India, Database on Indian Economy, Reserve Bank of India. By March 2015, 58% of these loans had gone to large borrowers – those with credit exposure exceeding Rs 50 million – mainly in the industrial and infrastructure sectors, according to data in a 2016 speech by N.S Vishwanathan, then a deputy governor at the Reserve Bank of India (RBI).

While high levels of domestic investment and credit growth were maintained for a few years after the global recession in 2008-09, profitability declined during that phase owing to global market conditions, cost-push inflation and domestic interest rate hikes. Once losses started accumulating in the private sector, companies began defaulting on their loans, in effect offloading the losses on to the major lenders, the PSBs. By March 2015, almost three quarters of the NPAs were on account of large corporate borrowers (Vishwanathan 2016).

This disproportionate concentration of PSB credit in large borrowers and a credit culture marked by corporate borrowers freeloading on the banks’ business risks was characterised by Raghuram Rajan, then the RBI governor, as "riskless capitalism":

What I am warning against is the uneven sharing of risk and returns in enterprise, against all contractual norms established the world over — where promoters have a class of “super” equity which retains all the upside in good times and very little of the downside in bad times, while creditors, typically public sector banks, hold “junior” debt and get none of the fat returns in good times while absorbing much of the losses in bad times. Why does it happen? Why do we have this state of affairs? The most obvious reason is that the system protects the large borrower and his divine right to stay in control (Rajan 2014).

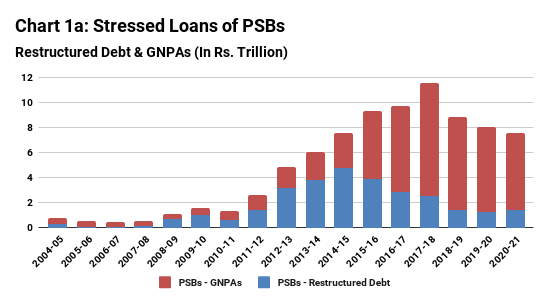

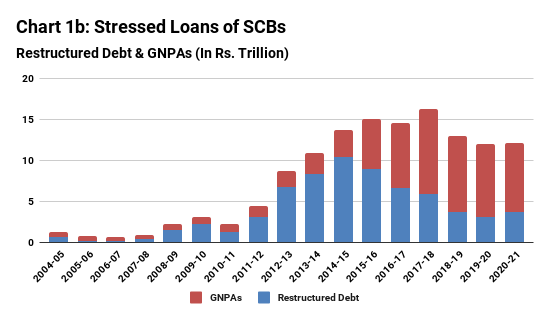

Faced with a surge in stressed loans from 2012–13, PSBs initially resorted to debt restructuring. They rolled over large amounts of corporate debt, deferring repayment schedules and renewing due loans. This kept gross NPAs artificially low even as the quantum of restructured debt shot up under UPA rule (see Charts 1a & 1b below).

“What I am warning against is the uneven sharing of risk and returns […] the system protects the large borrower and his divine right to stay in control.”

With the change of government at the centre in May 2014, the RBI intervened to discontinue such window dressing and undertook an Asset Quality Review in 2015-16. Following the review, bad loans were transparently recognised by reclassifying restructured debts as NPAs.

The BJP government has often put the onus of the bad loans accumulation on the reckless lending practices and "project bubbles" under the previous regime. It claims credit for bringing down the level of PSBs' stressed loans and NPAs, and improving NPA recovery through policy reforms. Are these claims tenable?

First, while gross amounts of stressed loans and NPAs have reduced after peaking at over Rs 16 trillion in 2017–18, they remain much higher than the level of stressed loans before the onset of the bad-loans crisis. Charts 1a & 1b also suggest a resumption of debt restructuring from 2019–20, particularly after the "asset classification standstill" announced by the RBI in the wake of the Covid-19 pandemic and lockdown in 2020. Therefore, the improvement of asset quality in terms of transparent recognition of NPAs in the recent period cannot be considered as irreversible.

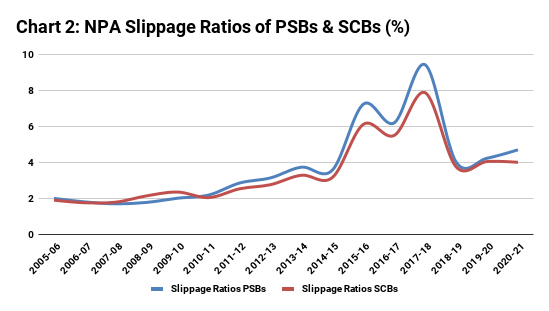

Second, the rate of fresh NPA accretions for the PSBs has shown a rising trend once again since 2019–20, after declining sharply in 2018–19 (Chart 2). 2This is the 'slippage ratio', defined as new accretion to NPAs in a period as a ratio to the standard advances at the beginning of the period. It provides the rate at which outstanding loans at the end of a period turn into NPAs in the next period. While the sharp increases in NPAs in 2015–16 and 2017–18 could be explained in terms of recognition of legacy NPAs, the large quantum of fresh NPA accumulation in recent times, alongside the persisting trend in debt restructuring, suggests that the problem of stressed loans is far away from being over.

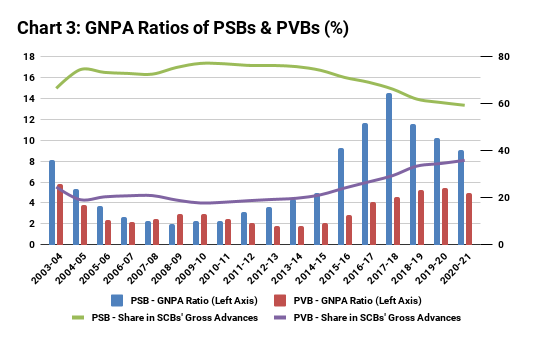

Third, under the NDA government, from 2014–15 to 2020–21, the PSBs’ annual average credit growth has fallen below 4%, a historic low. The PSBs’ share in SCBs' gross advances has declined to below 60% in 2020–21 from over 77% in 2009–10 (Chart 3). The debt overhang has not only persisted for almost a decade but has also led to the PSBs losing significant market share in the banking sector. Moreover, the growing share of private sector banks in gross advances since 2015–16 has also led to a significant increase in their average gross non-performing asset (GNPA) ratio in recent years (right axis in Chart 3). This deterioration of asset quality in the private banks implies that the bad loans problem is not PSB-specific; it is rather about the persistence of a degenerate credit culture.

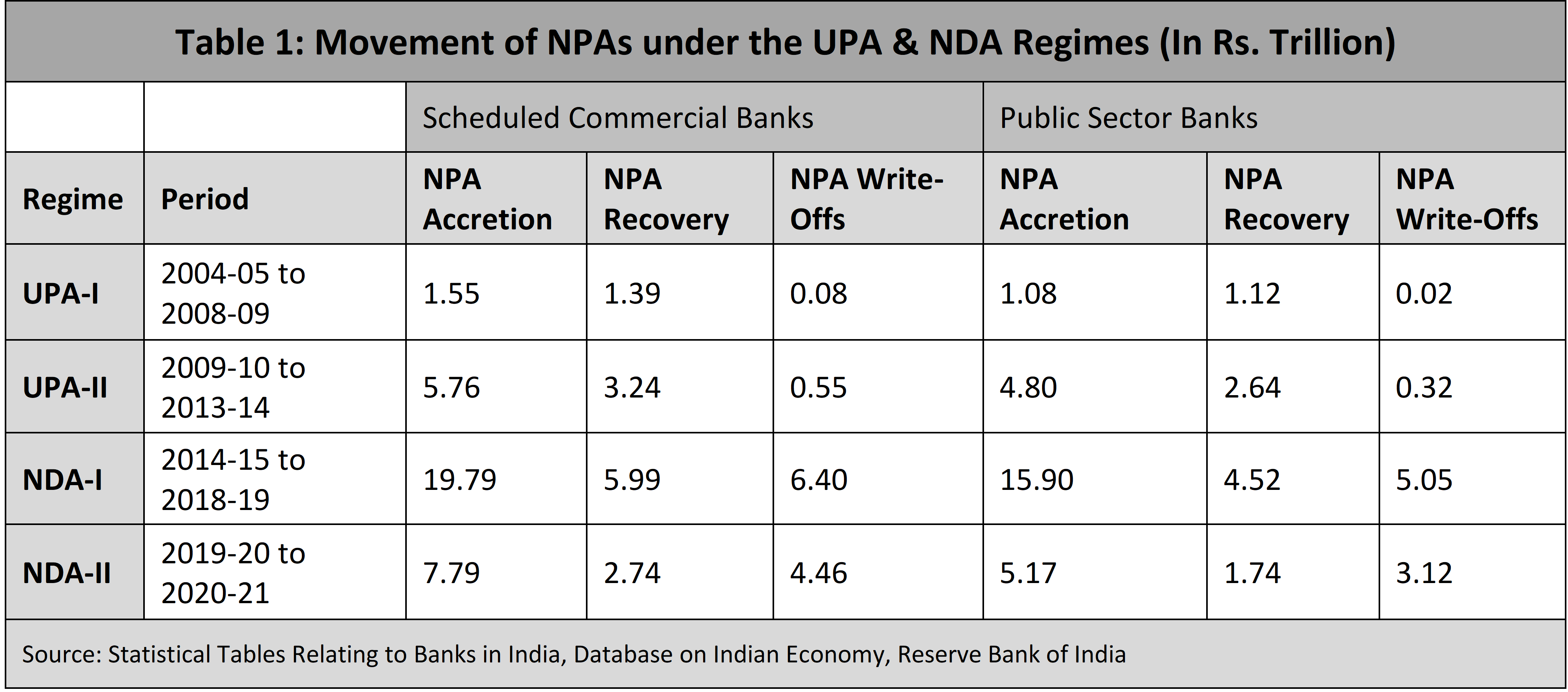

Finally, as Table 1 below shows, the bulk of the reduction of NPAs in the present government’s tenure has occurred through write-offs and not through recoveries. The data show that during the UPA-I and -II tenures, for every Rs 100 of NPA accretion in SCBs, Rs 63.34 were recovered and only Rs 8.62 were written off. Under NDA rule, however, only Rs 31.65 was recovered for every Rs 100 of NPA accretion, while write offs were at Rs 39.38.

Thus, if the UPA regime had presided over enormous accumulation of bad loans in the banking system through riskless capitalism, the NDA regime has enabled freebie capitalism — banks writing off almost Rs 11 trillion of NPAs in SCBs, out of which Rs 8 trillion were bad loans by the PSBs.

For every Rs 1 trillion of NPAs being resolved through the IBC channel, the banks are taking haircuts of more than Rs 670 billion.

The apparent improvement of NPA recovery (in nominal terms) during the rule of the BJP government is often attributed to the new recovery mechanism of the Insolvency and Bankruptcy Code, 2016 (IBC). But a closer look at data from the Insolvency and Bankruptcy Board of India shows that out of total admitted claims of Rs 7.67 trillion till June 2022, resolution through the IBC has yielded only Rs 2.35 trillion as realised amounts by the creditors (IBC 2022: 15) implying a recovery rate of only 30.6%. In other words, for every Rs 1 trillion of NPAs being resolved through the IBC channel, the banks are taking haircuts of more than Rs 670 billion.

Bank frauds also witnessed a surge during the BJP's rule, although the incidence has declined over the past two years. Over Rs 3 trillion has been lost by SCBs in bank frauds in the last eight years to 2021–22, out of which Rs 2.15 trillion were lost by the PSBs, the RBI said in an RTI reply in July. The total recovery stood at only Rs 336.46 billion. This only confirms the continued deterioration of credit culture under the present regime.

Write-offs and bail-outs

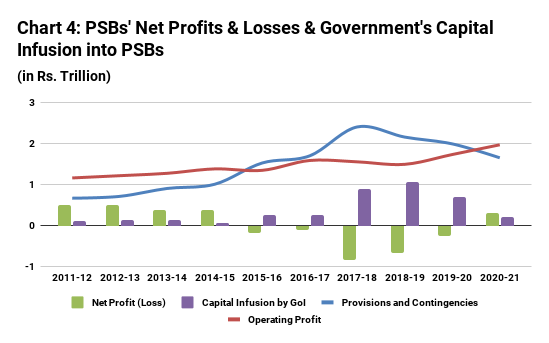

Massive write-offs of NPAs have caused serious financial losses for the PSBs. Between 2015–16 and 2019–20, the PSBs as a group made net losses every year, aggregating Rs 2 trillion in five years (Chart 4). Ironically, these net losses occurred despite rising operating profits at the PSBs, because NPA provisioning far outweighed these gains. Given the quantum of net losses borne by the PSBs during 2015–16 to 2019–20, capital erosion would have led to the capital ratios of several PSBs going below the RBI minimum threshold of 9%. This did not happen because the union government infused over Rs 3.4 trillion into the PSBs between 2014-15 and 2020–21. Thus, the PSBs were practically bailed out using taxpayers’ funds.

The finance ministry, however, has tried to obfuscate the link between NPA write-offs by the PSBs and fiscal costs inflicted on the state exchequer, by providing the following clarification in Parliament:

As borrowers of written-off loans continue to be liable for repayment and the process of recovery of dues from the borrower in written-off loan accounts continues, write-off does not benefit the borrower. Banks continue to pursue recovery actions initiated in written-off accounts through various mechanisms available ...

The finance ministry has tried to normalise these massive loan write-offs by the banks as "part of their regular exercise to clean up their balance-sheet." However, the magnitude of bad loans write-offs is unprecedented, as are the absolute levels to which NPAs have accumulated.

After having removed bad loans from balance sheets, banks have little incentive to pursue their recovery.

Moreover, to suggest that such write-offs "do not benefit the borrower" is fallacious, since the borrower's entire liability is absorbed as a loss by the bank, virtually converting the loan into a transfer to the loanee. After having removed bad loans from balance sheets, banks have little incentive to pursue their recovery. PSBs recovered just Rs 870 billion of the total of Rs. 6.84 trillion of NPAs written-off between 2016–17 and 2020–21, according to data provided by government to Parliament in December 2021. 3The recovery figure is provided in the reply to a question in the Rajya Sabha. Total PSB write-offs are estimated by aggregating the bankwise data on NPA Write-Offs provided in Annex-II of the reply. Hence, borrowers from PSBs who defaulted on their loans did not repay nearly Rs. 6 trillion of their debt, thereby deriving direct financial relief/benefit.

The names of the written-off NPA account holders remain undisclosed, in ostensible compliance with laws that prohibit the public disclosure of credit information. But a clue to their identity can be derived from observing the sharp decline in the share of large borrowers in commercial banks' gross NPAs to around 62% in March 2022 from nearly 76% two years earlier (RBI 2022: 55, 2021a:53). These large borrowers have been virtually been provided loan waivers without any transparency.

The Comptroller and Auditor General’s (CAG) performance audit report on the recapitalisation of PSBs as well as the NPA write-off process for the period between 2008–09 and 2016–17 was tabled in Parliament in 2017 but has not yet been taken up (it is listed as item number 9 in the subject list of the Public Accounts Committee). In the report the CAG had recommended that: “Efforts should be made by the Department of Financial Services to ensure that PSBs increase the quantum of recovery vis-à-vis write-offs” (CAG 2018: 56). While recommendation has been flouted with impunity by the PSBs, the finance ministry has covered up the humongous write-offs by characterising them as a “regular exercise” by banks.

Significant time has already elapsed since the 2017 CAG report and the data utilised in that report has already seen substantial revisions by the RBI. The analysis above shows that the bulk of the NPA write-offs and recapitalisation of PSBs occurred after 2016–17. A fresh CAG audit should therefore be conducted covering the period 2017–18 to 2021–22.

The finance ministry has covered up the humongous write-offs by characterising them as a “regular exercise” by banks.

The CAG has written to the union government seeking details about the ongoing performance audit of the government’s recapitalisation exercise of PSBs, the government told Parliament in March 2021, but the outcome of that communication is not public. In response to an RTI application, the CAG in June 2022 said:

Action taken notes were submitted by the Ministry as per prescribed procedure. These have been sent back to Ministry with vetting remarks of Audit. However, as this is one of the subjects selected by PAC for examination, no information in this regard can be provided as it may cause a breach of privilege of Parliament …

The CAG should critically examine the financial as well as legal merits of the massive NPA write-offs of large borrowers that have occurred in the past five years and estimate the loss to the public exchequer through additional expenses borne under PSB recapitalisation. The fresh CAG audit should also address discrepancies in NPA data reported by the RBI and by individual banks. Reform of existing laws and regulations that prohibit any dissemination of credit information is also necessary because such opacity is being misused to subvert the credit system.

Conclusions

A "presumptive loss" of around Rs. 1.76 trillion to the public exchequer during the allocation of 2G spectrum in 2008 led to a severe indictment of the telecom ministry by the CAG. Subsequently, the Supreme Court quashed the grant of telecom licences and spectrum allocation in 2012 for being wholly arbitrary and unconstitutional. The humongous bad loans write-offs by banks, especially the state-owned banks, should also come under similar scrutiny. Such "irrational freebies" deserve the Supreme Court's intervention, much more than the ones that are currently engaging the judiciary's attention.

Prasenjit Bose is an economist and activist based in Kolkata.